Analysis of Industry Analysis. Where are Sunglasses Heading?

Every year I read the same article, more or less, discussing the sunglasses sector of the eyewear industry. Here’s this year’s recycled version of it.

I’ll supply some commentary:

Shoppers are splurging on this hot item

Krystina Gustafson | @KrystinaGustafs

Thursday, 12 Jun 2014 | 2:32 PM ETCNBC.com

Consider it the new lipstick indicator.

Still hesitant to open their wallets, middle-class shoppers are increasingly turning to sunglasses to upgrade their style for less, snatching up multiple pairs at higher prices to fill a space in their armoires that handbags and jewelry have long dominated.

Their growing interest in the category is evident in its sales. Revenue from women’s sunglasses rose 9 percent in 2013, outpacing the 4 percent increase posted by women’s apparel, according to Accessories Magazine and The NPD Group.

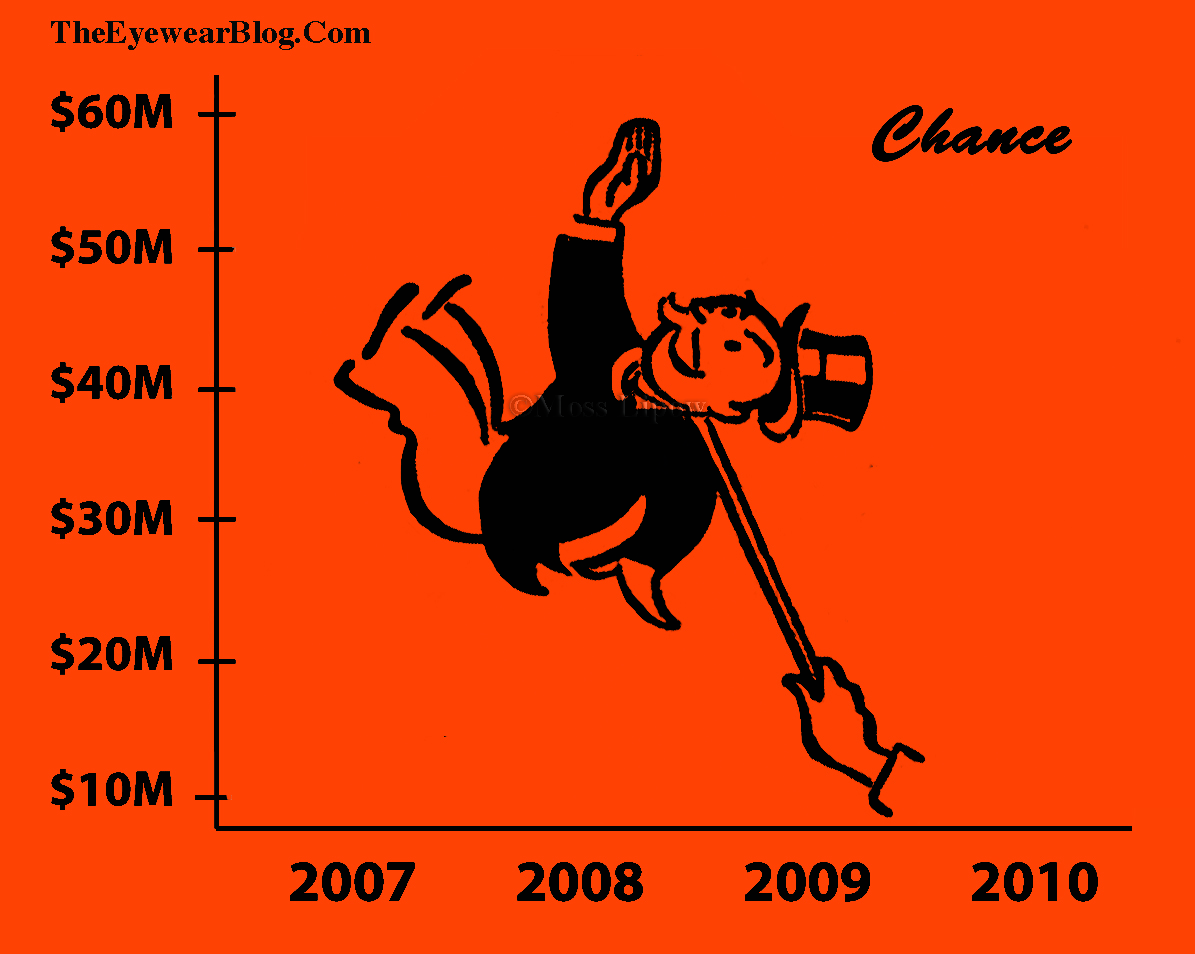

Me: Sunglasses usually take a larger hit than most accessories in down economies and sell faster in up economies. It happens over and over. But analysts are paid to come up with reasons, so…

“Accessories are clearly outperforming apparel in every aspect,” said Marshal Cohen, chief industry analyst at The NPD Group research firm.

There are a number of factors behind the growth in sunglasses, experts said. For one, eyewear has been a hot topic on the heels of fashion-forward retailer Warby Parker’s expansion, as well the launch of Google Glass.

Many consumers are also drawn to the category after seeing celebrities such as Victoria Beckham sporting bold looks in the tabloids, said Hana Ben-Shabat, a partner in the retail practice of A.T. Kearney, a global management consulting firm.

But a big driving force in sunglasses comes from so-called aspirational shoppers, who despite coveting designer goods, don’t have the income to be a true luxury consumer.

Since the end of the recession, these shoppers have been looking for ways to purchase high-end brands, but at a low cost. Sunglasses, Ben-Shabat said, fit the bill for these shoppers, as they sit on the lower level of the luxury pyramid.

Whereas a Gucci handbag typically sells for more than $1,000, many of the brand’s sunglasses go for about $300—a discount, relatively speaking. It’s a phenomenon similar to when consumers are feeling questionable about the economy. They purchase lower-price items, such as lipstick, to refresh their look for less money.

“You may not own the Gucci bag but you [can] buy the Gucci sunglasses,” Ben-Shabat said.

Me: So the main rationale for the traditional “up economy” sales rebound is: because licensed sunglasses are on the caboose of the luxury goods train, those of low means can wear them and pretend they’re “living the life”.

Interesting…

Perhaps Ben-Shabat is unaware plano sunglasses was a stronger sector within eyewear in the 1960s and early 1970s before designer licensing.

What’s more, since sunglasses are prominently featured on a person’s face, they’re a great way for an aspirational shopper to get the most bang for their buck, Cohen said.

Another factor driving the category’s sales is consumers’ growing interest in owning multiple pairs of sunglasses to suit different needs. Kristen McCabe, vice president of product at Sunglass Hut North America, said the Luxottica-owned retailer this year has seen two to five points’ growth in how frequently shoppers are walking out of the store with more than one pair.

Sunglass Hut has also seen its average checkout increase more than 10 percent so far in 2014, McCabe said.

“We know that [the] average American owns lots of shoes and handbags,” McCabe said. “They’re starting to think about eyewear in the same way, which is really important.”

Sunglass Hut is looking to capitalize on this shift with a new campaign that highlights the four different pairs of sunglasses each woman should own. They include sporty, for any time a woman is sweating, and what McCabe called the “wow” frame, which could be worn to a wedding or graduation.

It’s a push that aims to drive the average person in North America, who owns at least three pairs of sunglasses, to become more like the retailer’s most fashion-savvy customers, who own more than 20 pairs.

McCabe emphasized that North America still presents a large opportunity for Milan-based Luxottica, which in the most recent quarter saw only about one-fourth of its wholesale revenue come from the region.

That also makes the category a big opportunity for department stores, which are seeing the category’s sales grow at a rate of 5 percent, Cohen said.

“That’s the consumer seeking luxury at an affordable price,” he said.

Making online work

One of the biggest challenges for the category is drumming up online sales for a product that can be tricky to buy without first trying it on. Sunglass Hut is working around the issue by putting iPad tablets in its physical stores, where shoppers can access additional colors and styles from the 1,000 or so pieces it typically carries on its shelves.

The company also offers a 90-day return policy, so shoppers are less hesitant to pull the trigger on a pair they haven’t yet tried on.

Warby Parker allows consumers to order five pairs at a time for at-home try on, offering free shipping on deliveries and returns for the items customers don’t like. McCabe said Sunglass Hut plans to test a similar format in early 2015.

Tools such as these have helped the category’s online sales grow 48 percent in the 12 months ended March, according to The NPD Group.

Problem is with service and convenience taken out of the equation, Luxottica will have to compete with online retailers on price. Doing this without undercutting their own brick and mortar network will be like untying a Gordian Knot…

But despite all the buzz, Cohen remains doubtful the category will ever become a true substitute for women’s purses or fashion footwear, which pulled in $8.7 billion and $23.8 billion, respectively, last year. Sunglasses, on the other hand, rang in $1.8 billion.

“Good luck replacing the handbag or the shoe,” he said.

—By CNBC’s Krystina Gustafson

“Good luck replacing the handbag or the shoe, he said.”

But the main standard bearers for the category aren’t trying to replace the handbag or shoe. They’re trying to be a cheap alternative for people unable to afford real luxury goods – at least according to the article.

“Luxury” Sunglasses are really a sideline to the optical titans’ main business which seems to be expanding brick and mortar dispensaries as widely as possible to sell as much vertically integrated Rx product as possible.

So how good should anyone expect the sunglasses to be?

Changes are coming – and sooner than many think. Some editor will then have to write a totally new annual industry analysis article from scratch.

I look forward to reading it…

.

.

.

A couple of projects I’ve been working on will be moving forward. Blogs might become less regular as time gets squeezed. Please scroll to the top of the sidebar on your right and SUBSCRIBE to be informed of new posts.

Recent Comments